Mr. Reset

Money Trouble? Get debt relief that just works.

Simplify your life by consolidating multiple payments into one reduced monthly payment. Be debt free in as little as 18 months.

Secure online experience

Insight & support 24/7

Results in minutes

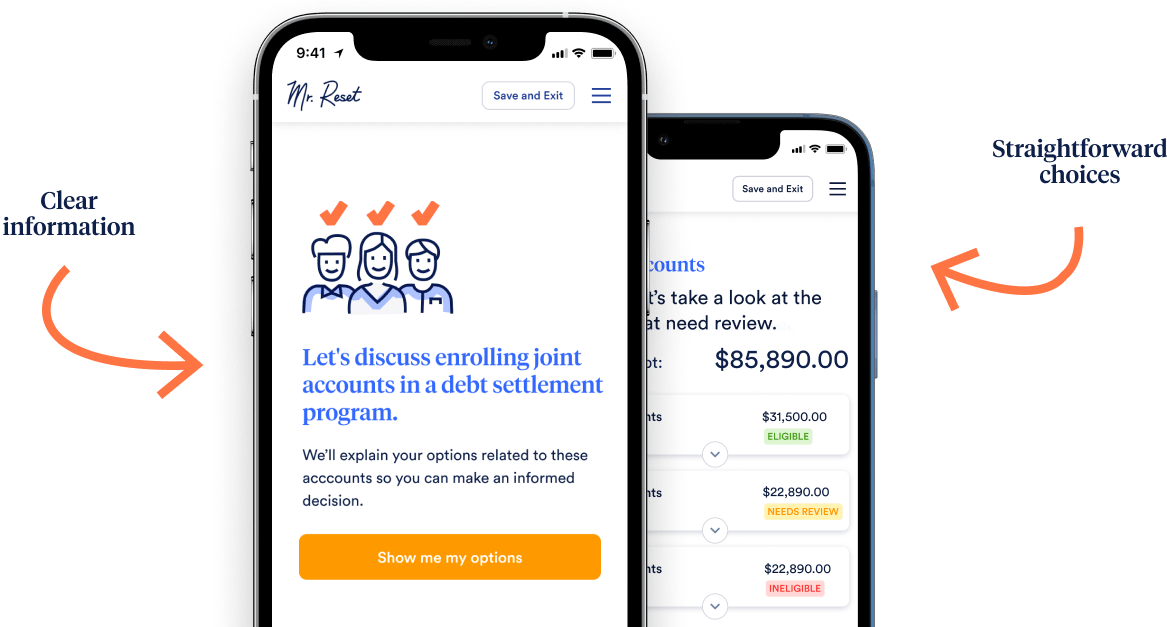

Less debt, less doubt. No calls required.

Mr. Reset helps individuals across the United States by offering debt settlement programs that work. Our customized plans will help you reduce what you owe, avoid filing for bankruptcy, and say goodbye to overwhelming debt.

Debt Settlement

If you’re having trouble paying off your debt, your creditors may be willing to negotiate. This might sound complicated but don’t worry—Mr. Reset can handle it for you. We can help with most unsecured debts, which are debts that do not have collateral attached to them, like credit cards, personal loans and lines of credit, medical bills, collection accounts, business debt and certain student loans.

Debt in America by the numbers

- 37%have used a buy now, pay later service within the last 12 months.

- 53%took on personal debt because of the pandemic.

- $385 Bborrowed from personal loans in last 12 months.

There’s no telling where the right debt relief strategy could take you.

Start your journey todayFrequently Found Answers

Who is Mr. Reset?

Mr. Reset is a service created by people who believe that tackling your debt shouldn’t begin with speaking to a stranger in a far-flung call center.

These are my finances we’re talking about. Is this service secure?

Mr. Reset doesn’t sell your data, which is protected by state-of-the-art security protocols and encryption. With your consent, Mr. Reset introduces you to a trusted partner to help you with your debt.

I’m busy and stressed. How long does this whole process take?

It depends on your situation, but the assessment questionnaire is quick and easy to follow.

Will Mr. Reset clear up all my debts for good?

Some options focus on unsecured debts. Bankruptcy, however, helps you resolve both secured and unsecured debts.

I can’t afford another bill! How much will all this cost?

Mr. Reset is free to use. But if you go ahead with a debt resolution strategy, you’ll pay the partner a fee. These fees vary, and some of them are contingent on performance.

If I decide to move ahead with a debt resolution program, is it risky?

You can pick a strategy, start pursuing it and stop before the program is complete. If you do this because you realize you need more aggressive assistance that may be ok. But if you just quit you could find yourself in a significantly worse financial position than before.

Will this process repair my bad credit?

No. But it can help you get your finances in order and access credit responsibly. That’s the best way to improve your credit rating in the long run.

Can I ever borrow again?

None of the debt resolution options offered prevent you from borrowing in the future.